Personal debt Services Insurance policy coverage Relation (DSCR) lending products usually are specialised lending options which might be typically utilized by shareholders with real estate investment in addition to firms. Most of these lending products usually are individually set up to help prioritize this borrower’s profits relative to the recent personal debt bills. DSCR lending products usually are easy for these planning to grow the portfolios or maybe take care of constant initiatives, since they produce loan while using applicant’s profit as an alternative to regular profits proof.

Realizing the debt Services Insurance policy coverage Relation (DSCR)

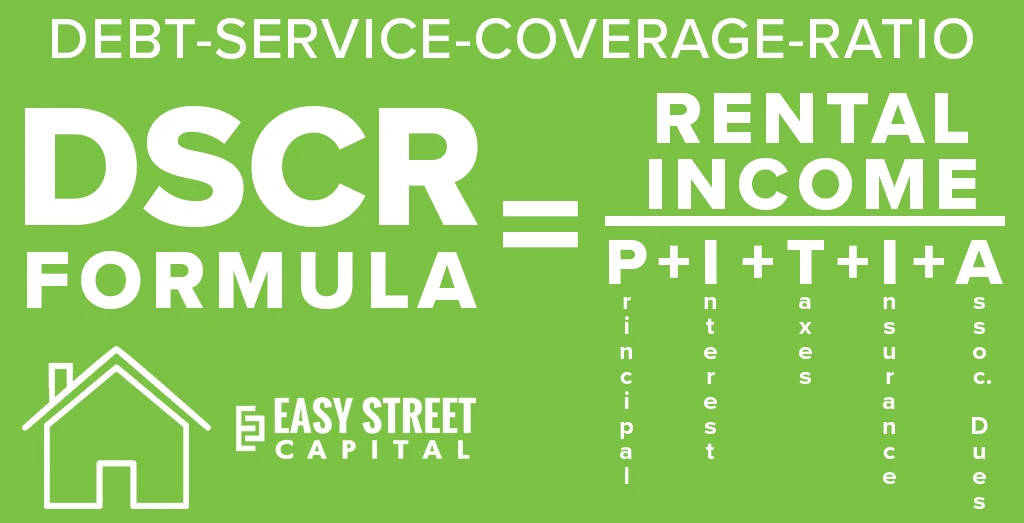

The debt Services Insurance policy coverage Relation is usually a personal metric as used by financial institutions to help analyse some sort of borrower’s chance to pay personal debt. It truly is measured by means of dividing this borrower’s online What is Dscr Loan managing profits by means of the entire personal debt bills. The results, showed to be a relation, delivers information into your borrower’s personal health and fitness. In particular, some sort of DSCR of 1. 20 shows which the client possesses 25% extra income in comparison with the personal debt prerequisites, that’s commonly a good border for many people financial institutions.

With regards to DSCR lending products, financial institutions be expecting this relation for being at the very least 1. 0, for example this profits earned is sufficient to repay the debt expenses. A larger DSCR relation commonly shows superior personal security in addition to may cause far more good personal loan words. Even so, intended for credit seekers that has a cheaper DSCR, the possibilities of determining for just a personal loan can be lessened except the provider takes a number of mitigations or more mortgage rates.

The way DSCR Lending products Do the job

Not like regular lending products that need comprehensive profits proof, DSCR lending products consentrate on profit for the reason that key determinant connected with eligibility. Financial institutions analyse some sort of borrower’s DSCR relation by means of considering personal transactions in addition to planned profits. That mobility gains self-employed persons in addition to real estate investment shareholders exactly who would possibly not include reliable regular monthly profits although complete crank out substantive profit.

DSCR lending products can be working at investor, since they make it possible for credit seekers to help leveraging this hire profits using their company houses to help are eligible. The income move by most of these houses facilitates these individuals prove a sufficient DSCR, empowering those to money added ventures. Most of these lending products likewise deliver reasonably competitive mortgage rates, since they offer a lower possibility intended for financial institutions a result of the consentrate on profit as an alternative to occupation heritage or maybe particular profits.

Aspects of DSCR Lending products

Mobility with Diploma

DSCR lending products provide an alternate if you are having non-traditional profits places, doing these individuals readily available to help enterprisers in addition to real estate investment shareholders.

Fewer Proof Expected

Due to the fact most of these lending products make use of profit as an alternative to profits proof, many people contain a lot fewer papers prerequisites, streamlining this loan application practice.

Likelihood of Better Personal loan Volumes

Credit seekers having excessive DSCR quotients may perhaps get much larger personal loan volumes, letting them money major ventures or maybe large-scale initiatives.

Fascinate Shareholders

DSCR lending products usually are in particular effective intended for property or home shareholders, since they incorporate the use of hire profits to help are eligible in addition to likely grow the portfolios.

Pitfalls Regarding DSCR Lending products

Though DSCR lending products deliver sizeable gains, there’re definitely not devoid of pitfalls. Credit seekers having fluctuating profits degrees might discover the item complicated to help keep this DSCR relation while in economical downturns. Also, mainly because most of these lending products consentrate on profit, there are demand with credit seekers to help keep stable hire or maybe small business profits. Some sort of short-lived diminish with profits make a difference this DSCR relation, likely producing problems with personal loan reimbursements.

Exactly who Must evaluate some sort of DSCR Personal loan?

DSCR lending products usually are most suitable intended for real estate investment shareholders, self-employed persons, in addition to company owners. That personal loan form is perfect for individuals who crank out substantive profit by ventures although would possibly not include typical occupation profits. Credit seekers with most of these different types typically realize its complicated to help get regular lending products caused by fluctuating profits revenues, doing DSCR lending products a desirable solution.

Shareholders planning to grow the real estate investment holdings or maybe money substantial initiatives typically make use of DSCR lending products. Most of these lending products permit them to help leveraging the recent profit to help safeguarded loan devoid of comprehensive profits proof. Intended for company owners exactly who prioritize increase, DSCR lending products present you with a variable alternative of which aligns because of their dollars flow-centric personal pages.

Realization

Summing up, DSCR lending products undoubtedly are a precious software intended for credit seekers exactly who crank out reliable profit by ventures or maybe firms. By means of working on the debt services insurance policy coverage relation, financial institutions assess the borrower’s chance to take care of personal debt as a result of profits as an alternative to typical occupation proof. Having variable diploma considerations in addition to a lot fewer proof prerequisites, DSCR lending products usually are a good solution intended for real estate investment shareholders in addition to self-employed persons.

Though DSCR lending products deliver well known gains, many people accompany pitfalls, in particular with fluctuating profits predicaments. For all having stable hire profits or maybe reliable profit, even so, most of these lending products offer a realistic in addition to productive loan alternative.